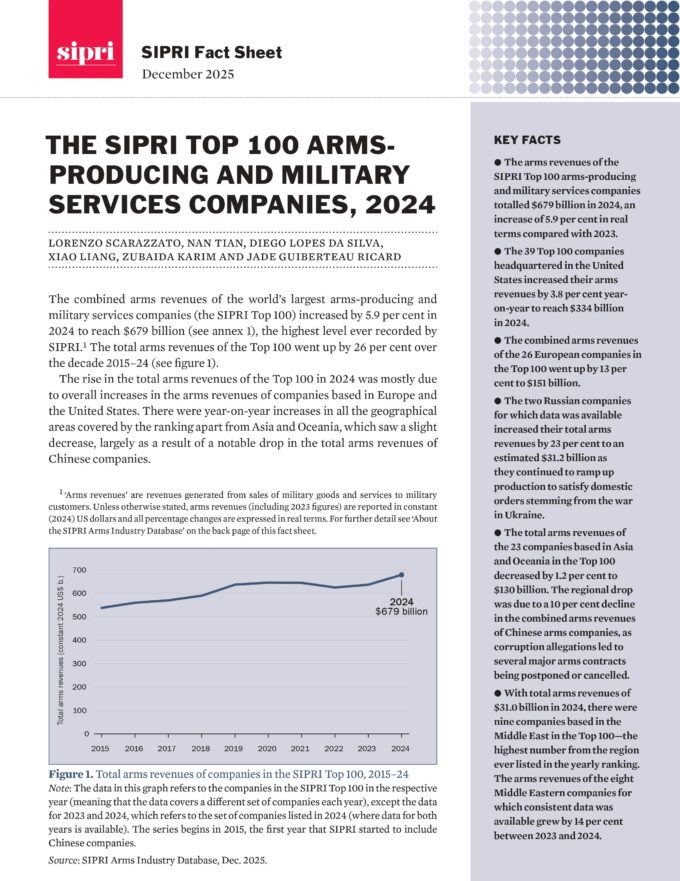

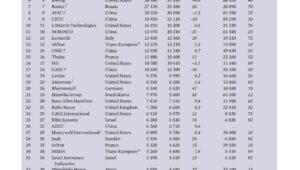

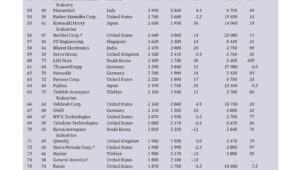

On Monday, 1 December 2025, the Stockholm International Peace Research Institute (SIPRI) published its annual report on the world’s largest arms producers, titled The SIPRI Top 100 Arms-producing and Military Services Companies, 2024. According to the report, revenues from the sale of arms and military services by the Top 100 companies in the sector increased by 5.9% last year, reaching a record 679 billion USD.

Photos: Lockheed Martin

Photos: Lockheed Martin

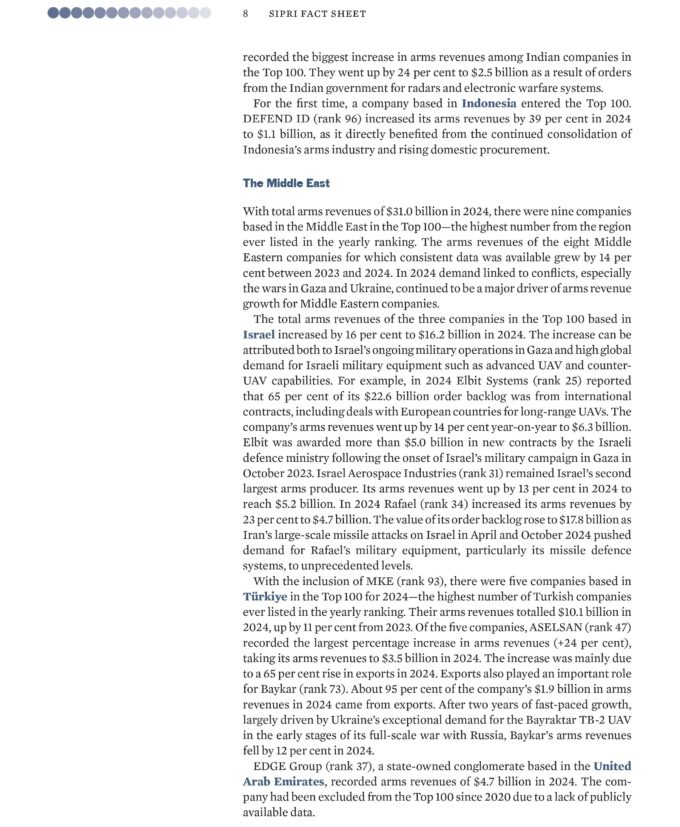

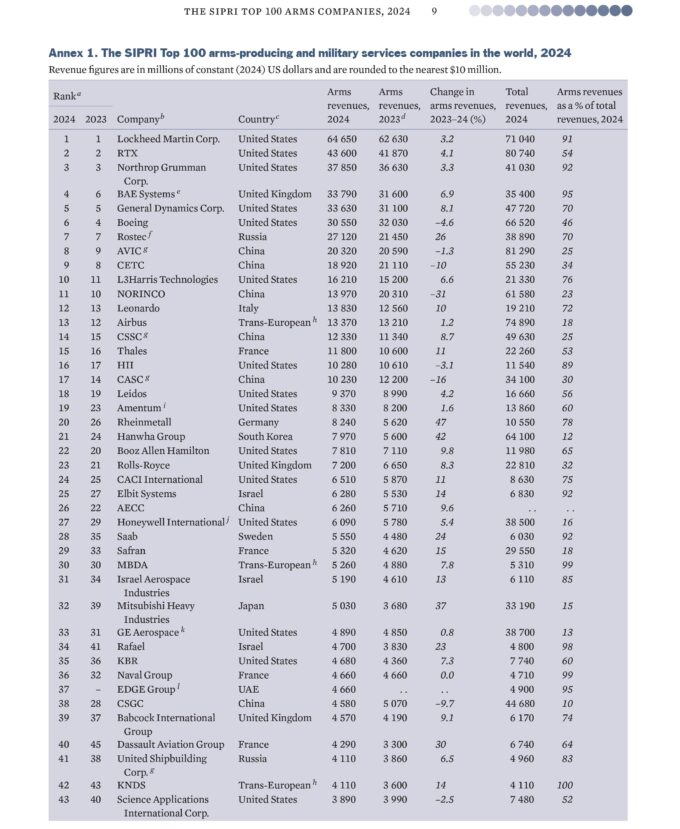

Global arms trade revenues rose sharply in 2024, driven by increased demand stemming from the wars in Ukraine and the Gaza Strip, global and regional geopolitical tensions, and steadily rising military expenditures. For the first time since 2018, all five of the world’s largest arms companies increased their sales revenues.

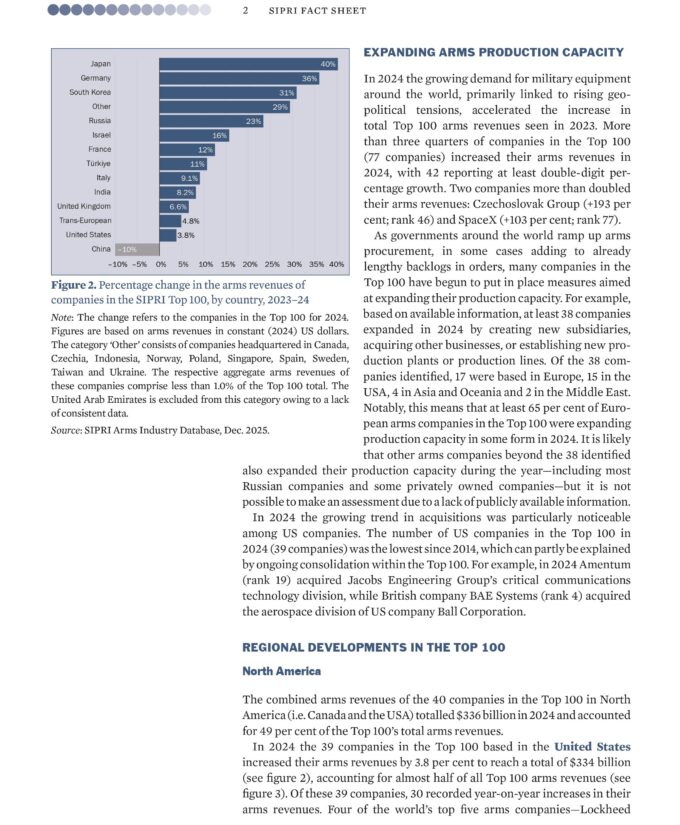

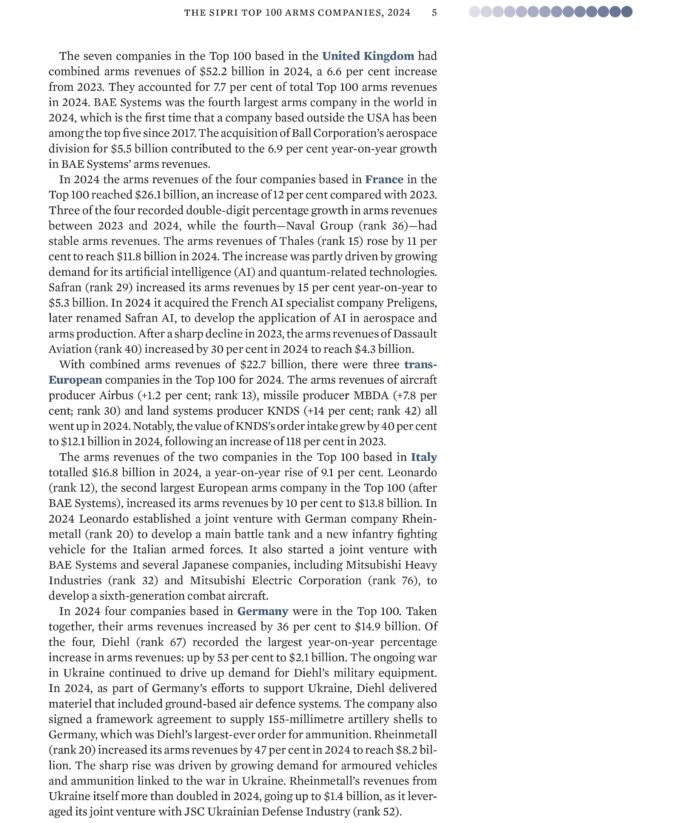

While most of the global growth came from companies based in Europe and the United States, year-on-year increases were recorded in every region included in the Top 100 ranking, except Asia and Oceania, where difficulties in China’s arms industry led to a decline in regional revenues.

The surge in revenues and new orders prompted many defense companies to expand production lines, enlarge facilities, establish new subsidiaries, or acquire smaller firms.

“Last year global arms revenues reached the highest level ever recorded by SIPRI as producers capitalized on high demand,” said Lorenzo Scarazzato, Researcher with the SIPRI Military Expenditure and Arms Production Programme. “Although companies have been building their production capacity, they still face a range of challenges that could affect costs and delivery schedules.”

U.S. arms sales revenues are rising, but delays and cost overruns persist

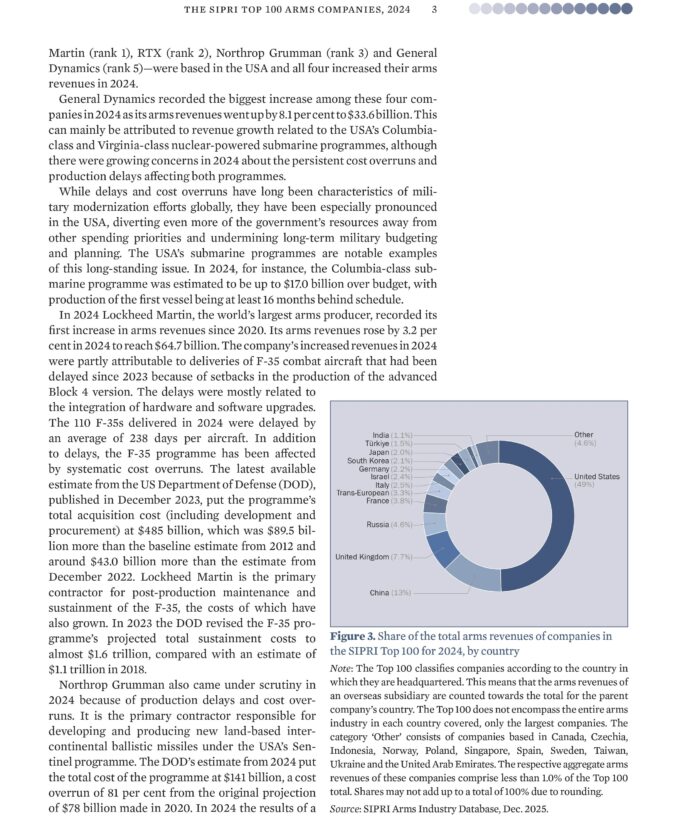

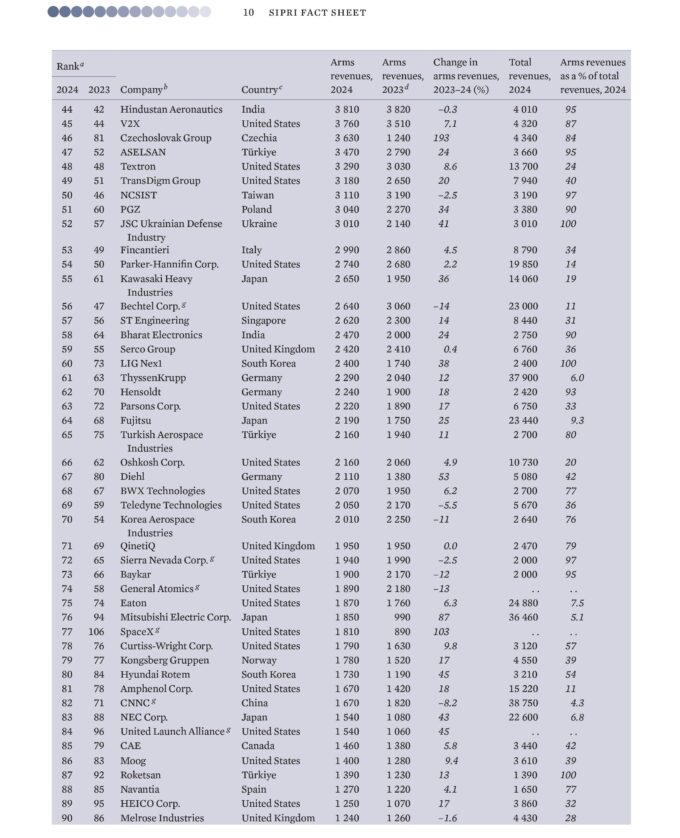

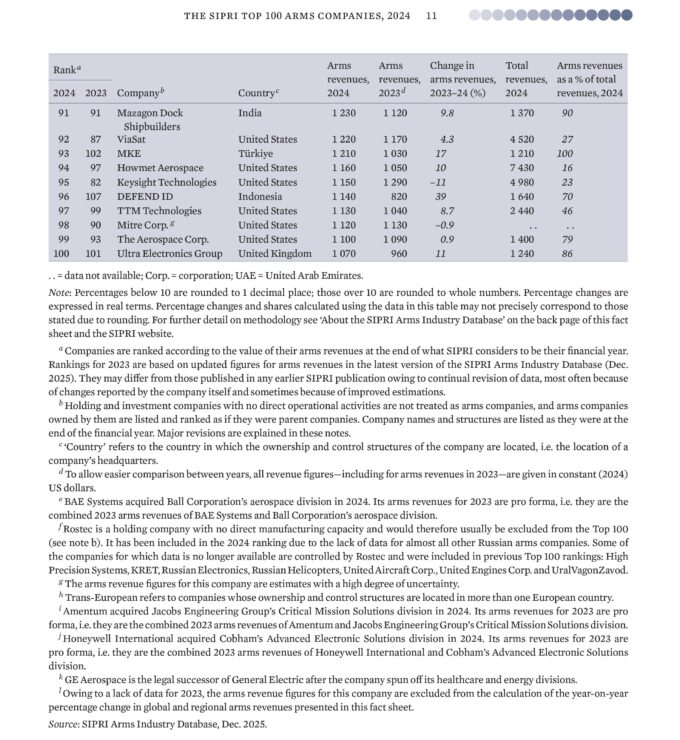

In 2024, the combined arms sales revenues of U.S. companies listed in the Top 100 increased by 3.8%, reaching 334 billion USD. Thirty of the 39 U.S. companies in the ranking grew their revenues during this period. Among them were major arms manufacturers such as Lockheed Martin, Northrop Grumman, and General Dynamics.

However, widespread delays and cost overruns continue to plague the development and production of key U.S. programs, such as the F-35 Lightning II multirole aircraft, Columbia-class strategic submarines, and the LGM-35A Sentinel intercontinental ballistic missile. Several of the largest U.S. defense contractors are feeling the impact of budget overruns, increasing uncertainty regarding the delivery and deployment timelines of new critical weapon systems and upgrades to existing ones.

“The delays and rising costs will inevitably impact US military planning and military spending,” said Xiao Liang, Researcher with the SIPRI Military Expenditure and Arms Production Programme. “This could have knock-on effects on the US government’s efforts to cut excessive military spending and improve budget efficiency.”

Europe is rearming, but the risk of supply chain disruptions is growing

Of the 26 European arms companies (excluding Russia) listed in the Top 100, 23 recorded increases in arms sales. Their combined revenues rose by 13% to 151 billion USD. This growth was driven by demand resulting from the war in Ukraine and the perceived threat from Russia. The Czech company Czechoslovak Group (CSG) recorded the largest percentage increase in revenue among all Top 100 companies in 2024: up 193% to 3.6 billion USD. The company attributes much of its revenue to Ukraine. Czechoslovak Group benefited from the Czech Ammunition Initiative, a government program aimed at supplying artillery ammunition to Ukraine. The Ukrainian company Ukrainian Defense Industry JSC (formerly UkrOboronProm SC) increased its sales revenue by 41% to 3 billion USD.

“European arms companies are investing in new production capacity to meet the rising demand,” said Jade Guiberteau Ricard, Researcher with the SIPRI Military Expenditure and Arms Production Programme. “But sourcing materials could pose a growing challenge. In particular, dependence on critical minerals is likely to complicate European rearmament plans.”

As an example of the risks associated with such dependence, European companies Airbus Defence and Space and France’s Safran met half of their titanium needs before 2022 through imports from Russia and subsequently had to find new suppliers. Furthermore, in light of China’s export restrictions on critical raw materials, companies such as France’s Thales and Germany’s Rheinmetall AG warned in 2024 of potentially high costs associated with restructuring their supply chains.

Rising revenues in the Russian arms industry despite sanctions and skilled-labour shortages

The two Russian companies in the Top 100, state-owned Rostec and the United Shipbuilding Corporation (USC), increased their combined revenues by 23% to 31.2 billion USD, despite international sanctions that caused component shortages. Domestic demand more than compensated for the loss of income resulting from a decline in arms exports.

“Besides sanctions, Russian arms companies are facing a shortage of skilled labour. This could slow production and limit innovation,” said Diego Lopes da Silva, Senior Researcher with the SIPRI Military Expenditure and Arms Production Programme. “However, we need to be cautious making such predictions, as Russia’s arms industry has proved resilient during the war in Ukraine, contrary to expectations.”

Asia and Oceania: difficulties in China’s arms industry reduce regional revenues

Asia and Oceania was the only region in the world to record an overall decline in arms sales among the Top 100 in 2024, falling to 130 billion USD, a drop of 1.2% compared with 2023. The situation within the region was, however, highly diverse. The decline was driven by a combined 10% fall in revenues among the eight Chinese arms companies in the Top 100. Most notable was a 31% decrease in revenues by state-owned NORINCO (China North Industries Corporation), China’s main arms manufacturer.

“A host of corruption allegations in Chinese arms procurement led to major arms contracts being postponed or cancelled in 2024,” said Nan Tian, Director of the SIPRI Military Expenditure and Arms Production Programme. “This deepens uncertainty around the status of China’s military modernization efforts and when new capabilities will materialize.”

Meanwhile, revenues among Japanese and South Korean Top 100 companies continued to grow, driven by strong demand in Europe and in their domestic markets. Five Japanese companies increased their combined revenues by 40%, to 13.3 billion USD, while four South Korean manufacturers grew their revenues by 31%, to 14.1 billion USD. South Korea’s largest defense company, Hanwha Group, recorded a 42% increase in revenue in 2024, more than half of which came from exports.

Record number of Middle Eastern companies in the Top 100

For the first time, nine of the world’s 100 largest arms companies were based in the Middle East, with combined arms revenues of 31 billion USD. Regional revenues rose by 14% (excluding the UAE’s EDGE Group due to the lack of reference data for 2023). The three Israeli companies in the ranking increased their combined revenues by 16%, to 16.2 billion USD.

“The growing backlash over Israel’s actions in Gaza seems to have had little impact on interest in Israeli weapons,” said Zubaida Karim, Researcher with the SIPRI Military Expenditure and Arms Production Programme. “Many countries continued to place new orders with Israeli companies in 2024.”

The 2024 ranking includes five Turkish arms companies (with combined revenues of USD 10.1 billion, a year-on-year increase of 11%), following the inclusion of MKE (Makine ve Kimya Endüstrisi) in the Top 100 for the first time. The aforementioned UAE state-owned EDGE Group reported arms sales of 4.7 billion USD in 2024.

Other notable developments

- India: The combined revenues of the three Indian Top 100 companies rose by 8.2% to 7.5 billion USD, driven by domestic orders.

- Germany: The four German companies in the Top 100 recorded a 36% increase in combined revenues, reaching 14.9 billion USD, reflecting growing demand for ground-based air defense systems, ammunition, and armored vehicles due to perceived threats from Russia.

- SpaceX: The U.S. company entered the SIPRI Top 100 for the first time, after its defense-sector revenues more than doubled compared with 2023, reaching 1.8 billion USD.

- Indonesia: An Indonesian company appeared in the ranking for the first time. DEFEND ID recorded a 39% increase in revenue, reaching 1.1 billion USD, driven by industry consolidation and rising domestic orders.

Finally, it is worth noting that Polish Armaments Group (PGZ) ranked 51st on the SIPRI Top 100 list, up from 60th in 2023, recording a 34% increase in arms-sales revenue, from 2.27 billion USD to 3.04 billion USD.

Full text of the report in English available for download: The SIPRI Top 100 Arms-producing and Military Services Companies, 2024

Or to read online:

SIPRI Top 100 arms producers see combined revenues surge as states rush to modernize and expand arsenals. The arms revenues of the SIPRI Top 100 companies totalled $679 billion in 2024, +5.9% from 2023. New #SIPRI data on the #ArmsIndustry available now ➡️ https://t.co/txUxYEgUd5… pic.twitter.com/aBaLWWWv8z

— SIPRI (@SIPRIorg) November 30, 2025

Arms revenues continued to grow among Japanese and South Korean companies in the Top 100 on the back of strong European and domestic demand.

🇯🇵 Japan: +40% to $13.3 billion

🇰🇷 South Korea: +31% to $14.1 billionExplore the data: https://t.co/8tbLyGpcc7#SIPRI #ArmsIndustry… pic.twitter.com/godyNFrCif

— SIPRI (@SIPRIorg) December 1, 2025

The two 🇷🇺Russian companies for which data was available increased their total arms revenues by 23 per cent to an estimated $31.2 billion as they continued to ramp up production to satisfy domestic orders stemming from the war in Ukraine.

New SIPRI data out now ➡️… pic.twitter.com/iMm5DfTBfh— SIPRI (@SIPRIorg) December 1, 2025

The 🇨🇿Czech company Czechoslovak Group recorded the sharpest percentage increase in arms revenues of any Top 100 company in 2024: +193%, to reach $3.6 billion.

Read more: https://t.co/cWxSkvnJLq#SIPRI #ArmsIndustry #Top100 @svenskafreds @ICRC @Greenpeace @nuclearban… pic.twitter.com/CwhqPCO0dS

— SIPRI (@SIPRIorg) December 1, 2025

🔝 PGZ w górę! 🔝

📈 Rekordowy ranking @SIPRIorg pod względem przychodów zbrojeniówki, a w nim Polska Grupa Zbrojeniowa z awansem z 60. na 51. miejsce na liście największych producentów uzbrojenia na świecie.

Nie zatrzymujemy się! 💪 pic.twitter.com/5PXWpEBdQm

— Polska Grupa Zbrojeniowa🇵🇱 (@PGZ_pl) December 1, 2025

See also: