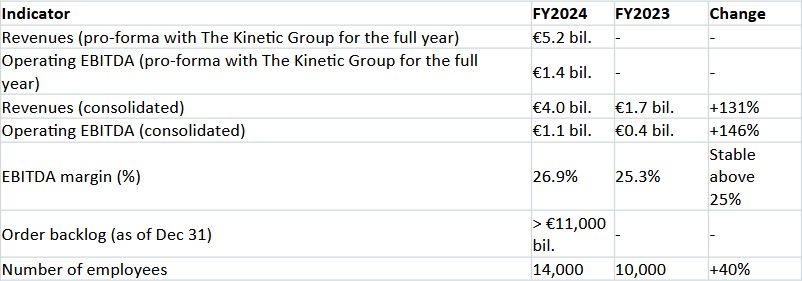

Pro-forma revenues of the Group, including The Kinetic Group for the full year 2024, reached €5.2 billion. The Kinetic Group transaction was finalized at the end of November 2024 and contributed only one month to the consolidated revenues of the CSG Group for 2024. As a result, the Group’s consolidated revenues reached €4 billion, representing a 131% increase compared to €1.7 billion in 2023, driven primarily by strong organic growth.

Pro-forma operating EBITDA, including The Kinetic Group for the full year 2024, amounted to €1.4 billion. Consolidated operating EBITDA, which includes one month of The Kinetic Group’s results, reached €1.1 billion, more than doubling from €0.4 billion in 2023 (an increase of 146%), while simultaneously improving the EBITDA margin to 26.9%.

Net profit for 2024 reached €526.1 million, a 202% increase from €174.1 million in 2023, reflecting exceptional profitability. The Group’s backlog exceeded €11 billion at the end of 2024.

The Group’s debt remains low despite the acquisition of The Kinetic Group, with a stable net debt-to-EBITDA ratio of 1.3x.

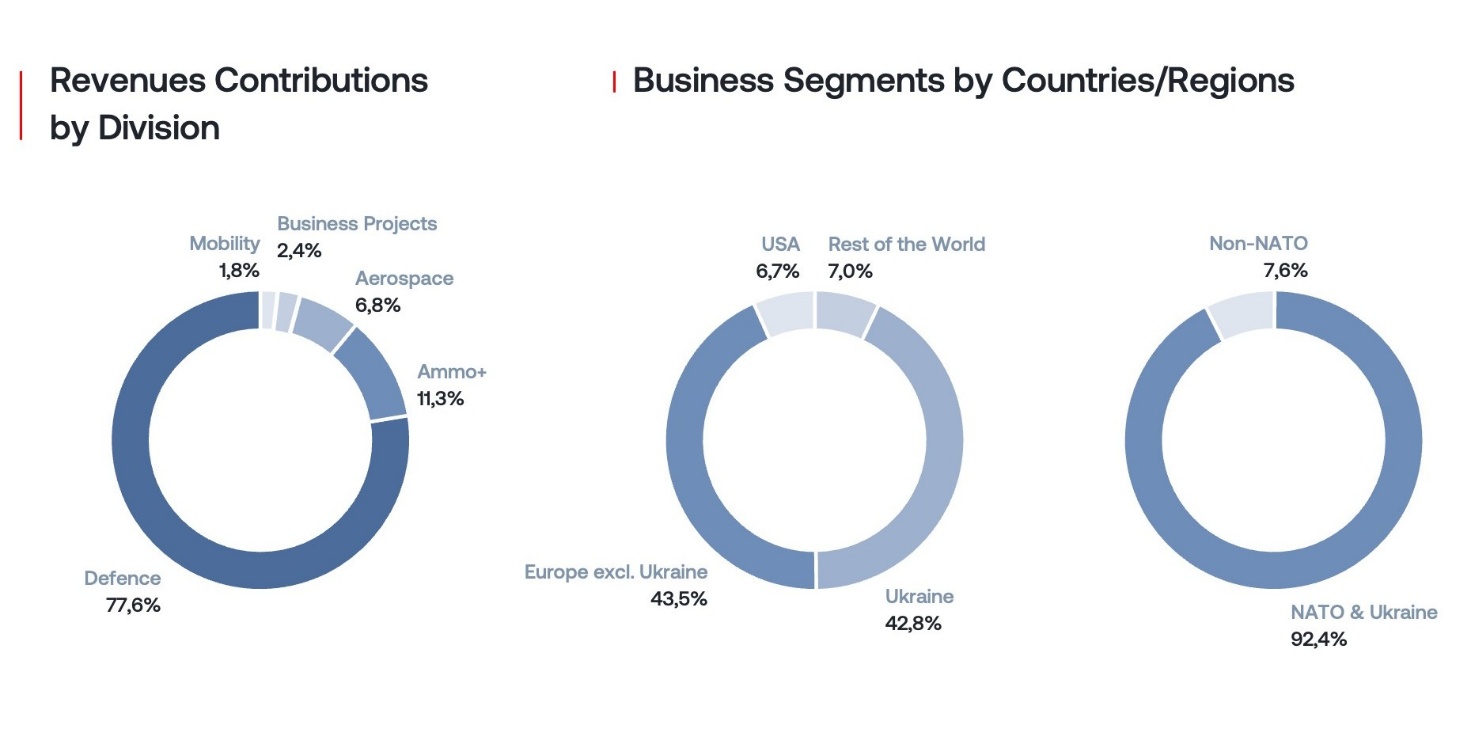

Europe (excluding Ukraine) accounted for 43.5% of its revenues, while Ukraine contributed 42.8%, underscoring CSG’s dominance in defence markets. The USA added 6.7%, reflecting only one month of results from our recent acquisition The Kinetic Group. The rest of the world contributed 7.0%.

NATO markets generated 49.6% of sales, while non-NATO markets (primarily Ukraine) accounted for 50.4%. If Ukraine is classified as NATO-aligned, NATO exposure rises to 92.4%. The defence sector contributed 83.6% of revenues, with the CSG Defence division alone generating 77.6% of total sales (€3.3 billion), solidifying its role as the Group’s primary growth driver.

The number of employees grew to over 14,000, working primarily across 37 production facilities, mostly in the EU and USA, with products supplied to more than 110 countries worldwide. Through the acquisition of The Kinetic Group, CSG has become the most significant manufacturer of small-caliber ammunition in the USA and one of the largest globally. Michal Strnad, owner and Chairman of the Board of CSG, aims to position the Group as one of the top two defence industry companies in Europe through rapid growth and strategic acquisitions.

Czechoslovak Group’s owner Michal Strnad states:

Europe stands at a pivotal moment where the defence industry is no longer merely an economic sector—it is a cornerstone of our sovereignty and security. The dramatic rise in defence spending across the continent reflects a clear recognition of this reality, and CSG’s record-breaking results in 2024 prove we are ready to meet this historic challenge. Our growth is not just about numbers—it’s about ensuring that Europe’s democracies have the tools to protect freedom in an increasingly unstable world.

Michal Strnad adds:

Thanks to our acquisition of The Kinetic Group, we are now the most significant manufacturer of small-caliber ammunition in the USA and one of the largest globally. My ambition is to build CSG into one of the two most significant defence industry companies in Europe, a goal we are steadily approaching with every strategic step we take.

Zdeněk Jurák, Member of the Board of Directors and Chief Financial Officer of CSG, notes:

In 2024, CSG strengthened its position as Europe’s fastest-growing major defence company, more than doubling both revenue and EBITDA through organic growth and strategic investments. Our debt levels, which have remained low even after the landmark acquisition of The Kinetic Group, demonstrate strong cash flow and disciplined financial management. Lastly the Group’s backlog, exceeding €11 billion, underscores our ability to secure long-term contracts and our position as a trusted partner on global defence markets.

Selected Indicators

Summary of Developments on the Group’s Main Markets

In 2024, CSG strengthened its leadership in the global defence industry by expanding production capacity and enhancing operational efficiency. Revenues from Ukraine quadrupled from €0.4 billion to €1.7 billion. In European Union markets, CSG saw a 90% increase in revenues, reaching €1 billion, while in its home market of the Czech Republic, revenues nearly doubled to €0.5 billion. Meanwhile the acquisition of The Kinetic Group increased its US revenues. Pro-forma figures indicate a potential annual contribution of €1.3 billion. Consolidated figures, which include only one month of The Kinetic Group’s results (December), show a 16% revenue increase to €0.3 billion.

The dominance of the defence sector (83.6% of revenues) reflects CSG’s pivotal role in supplying NATO countries and their allies, with the CSG Defence division generating €3.3 billion in sales. Investments into production capacities—particularly in Slovakia, Spain, and the USA—along with technological innovations, were key drivers of this growth. Despite a tripling of gross debt to €3 billion due to the Kinetic acquisition, CSG’s net debt remains low at 1.3x EBITDA, demonstrating its financial stability.

The CSG Defence Division: Powering Unprecedented Growth

The CSG Defence division, contributing 77.6% of revenues, is the backbone of the Group’s success. Sales of military land systems and large-caliber ammunition surged, with expanded production capacities in Slovakia and Spain addressing heightened demand from NATO countries as they restock their arsenals. Zdeněk Jurák notes: Our ability to deliver not only top-tier products but also upgrades to them, new technologies, and lifecycle support ensures long-term quality for our customers and stability for our Group.

CSG Ammo+ and The Kinetic Group: A Transformative Addition

The CSG Ammo+ division, strengthened by the acquisition of The Kinetic Group at the end of 2024, contributed €0.5 billion to revenues (11.3% of total sales), with Kinetic’s results included for December alone. Pro-forma figures project an annual contribution of €1.7 billion, emphasizing its growing significance on small-caliber ammunition markets, particularly in the USA.

CSG Aerospace and Mobility: Steady Contributors

The CSG Aerospace division generated €0.3 billion (6.8% of revenues), driven by demand for radar systems and aviation services due to increased airspace security needs worldwide. The CSG Mobility division, encompassing rail and automotive activities, contributed €0.1 billion (1.8% of revenues).

Financial Stability Amid Expansion

Despite the acquisition of The Kinetic Group, CSG maintained a net debt-to-EBITDA ratio of 1.3x. This low debt burden, even with gross debt rising to €3 billion, underscores CSG’s ability to manage cash flow effectively and finance growth without compromising stability.

Our Backlog: A Foundation for Future Growth

A backlog exceeding €11 billion confirms the stability of CSG’s growth in the coming years.

Pro-Forma Analysis with The Kinetic Group: A Transformative Rise in Scale

The late-2024 acquisition of The Kinetic Group amplified CSG’s global presence, with pro-forma revenues reaching €5.2 billion. Meanwhile pro-forma operating EBITDA rose to €1.4 billion. While the 2024 consolidated results include only one month of Kinetic’s performance (December 2024), the full-year pro-forma analysis highlights its transformative impact, boosting the Group’s U.S. revenue share to 25.9% (€1.3 billion) and elevating the Ammo+ division to 30.4% of total sales. This expansion underscores CSG’s strategic leap into the small-caliber ammunition market while maintaining a strong 26.9% EBITDA margin, reinforcing its leadership as Europe’s fastest-growing major defence company.

CSG Bolsters Dual-Use Innovation with Presto Tech Horizons

In 2024, CSG took a significant step toward advancing dual-use innovations by partnering with Presto Ventures to establish Presto Tech Horizons (PTH), an investment fund with a planned volume of up to €0.2 billion targeting cutting-edge security and defence technologies. This strategic move enhances CSG’s ability to integrate innovative solutions into its product portfolio, leveraging dual-use technologies for both civilian and military purposes. PTH’s focus on fast-growing startups developing breakthrough solutions in areas like artificial intelligence, cybersecurity, and aerospace aligns with CSG’s long-term vision of remaining at the forefront of global technological innovation. The fund’s first investments, announced in October 2024, include companies like Vidar Systems and Bavovna, whose technologies could potentially enhance CSG’s offerings in defence and security systems.

Commitment to ESG and Community Support

In 2024, CSG and its owner Michal Strnad reaffirmed their commitment to ESG and CSR through a wide range of initiatives. Regarding ESG, the company reported for the first time in compliance with the CSRD directive and European ESRS standards, marking a key milestone in its focus on transparency and responsible management of its environmental, social, and governance aspects, with all non-financial data verified by an independent auditor.

Key initiatives included rapid aid following floods in the Moravian-Silesian region, where Tatra Trucks donated eleven vehicles to the Fire Rescue Service and Excalibur Army provided two engineering bridge structures for a temporary bridge in Česká Ves after the 2024 floods in the northeast of the Czech Republic. CSG also supported Ukraine with equipment such as drones and generators for the villages of Staryi Martinov and Zborov, in collaboration with Czech Defence Minister Jana Černochová. The Group expanded its Employee Sponsorship Program to support employees’ extracurricular activities globally beyond the Czech Republic and donated to the Czech Military Solidarity Fund on Veterans’ Day. The company continued its multi-year commitment running since 2023 to support the Institute of Hematology and Blood Transfusion in leukemia research and provided aid to individuals, such as to the daughter of a Tatra Trucks employee with a rare illness. Building on these efforts, CSG established the CSG Foundation in March 2025, formalizing its long-term commitment to social responsibility and amplifying its impact in 2025 and beyond.

Press release

https://twitter.com/CSG_HOLDING/status/1907707140078461089