- Very dynamic military business: Group sales up in the first nine months by 36% to €6.3 billion

- Operating result jumps from €410 million to €705 million by 72%

- Operating margin in the Group climbs to 11.3%

- Orders increased significantly: Rheinmetall Nomination rose 48% to over €21 billion

- New record high for order backlog: Rheinmetall Backlog grows significantly to €52 billion

- Operating free cash flow improves by €527 million to €99 million

- Guidance for 2024 is confirmed

7th November 2024. Düsseldorf-based Rheinmetall AG closes the third quarter of 2024 with new record highs both in terms of sales and earnings. The very dynamic market situation in the military business sees continued high demand by the armed forces of Germany and partner nations in the EU and NATO, as well as the ongoing aid for Ukraine. However, the civilian sector of the Group remained slightly below the previous year.

The Group achieved a significant improvement in operating free cash flow with large-volume customer advance payments.

Due to the expected business development in the fourth quarter of 2024, the Group management confirms its sales and earnings guidance for fiscal year 2024 in the Group. Rheinmetall is now aiming for an operating result margin at the upper end of the guidance.

Armin Papperger, CEO of Rheinmetall AG, on the company development:

Rheinmetall is needed, as demonstrated by our numerous successful orders. We are experiencing growth like we have never seen before in the Group. We have entered into pioneering collaborations and have promising projects in many countries – for example in the USA, Great Britain, Italy and Ukraine. We have major orders in our pipeline, which will ensure further growth in sales in the years to come. In addition, we are building new production facilities, expanding our capacities massively and making strategic acquisitions. This will bring us closer to our goal of becoming a global champion in the defence industry.

Rheinmetall Group: Profitable sales growth of 36% – Rheinmetall Nomination increased by half

After nine months, Group sales increased noticeably by € 1,650 million or 36% to €6,268 million compared to the previous year (previous year: €4,618 million). The share of sales generated by the German customer increased by 6 percentage points to 30% in the first three quarters of 2024 compared to the same period of the previous year, while the foreign share was 70%.

As of September 30, 2024, the operating result amounted to €705 million up by €295 million or 72% compared to €410 million in the previous year. In addition to sales growth, the improvement in the operating result was driven among others by earnings contribution from Rheinmetall Expal Munitions, which was acquired in August 2023 in Spain. By the end of the third quarter of 2024, the Group’s operating margin improved to 11.3% (previous year: 8.9%).

Earnings per share from continuing operations improved compared to the same period of the previous year from €4.88 to €7.32 in the first nine months of the 2024 fiscal year.

The operating free cash flow advanced significantly compared to the previous year by €527 million to €99 million, after having stood at -€428 million in the same period of the previous year. The main driver for the positive development of operating free cash flow is the increase in customer advance payments received. The positive effect is mitigated by the multiple capex projects and the further build-up of inventories for the anticipated sales development in the fourth quarter.

The value of Rheinmetall Nomination increased significantly by 48% compared to the same period of the previous year. It increased in the first nine months to €21.4 billion (previous year: €14.5 billion). The main reasons for this were among other things, orders from Germany – here primarily from the special fund of the Bundeswehr – and orders to aid Ukraine. Rheinmetall Nomination comprises traditional incoming orders as well as the volume from future call-offs under new framework agreements entered into with military customers and new contracts with civilian clients (nominations).

As a result, the Rheinmetall Backlog increased significantly by 41% from €36.7 billion to €51.9 billion (September 30, 2024) compared to the previous year. In addition to orders on hand, Rheinmetall Backlog also includes the call-offs expected from framework agreements in place with military customers and the potential from contracts with civilian clients.

Vehicle Systems: Rheinmetall Backlog rises by 37% compared to the previous year

Sales at Vehicle Systems, with activities primarily in the field of military wheeled and tracked vehicles amounted to €2,537 million after nine months of the fiscal year of 2024, up €865 million or 52% year-on-year. This increase is mainly due to the delivery of pre-produced swap body systems (trucks) and the start of tactical vehicle programs.

Rheinmetall Nomination – the total of order intake and the volume of newly concluded framework agreements with military customers – increased by €1.9 billion to around €6.8 billion compared to the previous year. The largest orders in 2024 are thus far a new framework agreement to supply UTF category military trucks to the Bundeswehr in the amount of €2.9 billion, the order for the manufacture and supply of the German armed forces’ heavy weapon carrier based on the Boxer wheeled vehicle, with a volume of over €1.6 billion, as well as the associated service contract with around €630 million.

Rheinmetall Backlog – the total of orders on hand and the call-offs expected from framework agreements in place with military customers – was with €20.6 billion as at September 30, 2024, €5.6 billion or 37% higher compared to the previous year. The operating result improved from €182 million to €281 million. With 11.1%, the operating result margin was above the prior year’s margin of 10.9%.

Weapon and Ammunition: Backlog once again increased significantly to around €20 billion

Weapon and Ammunition achieved record sales of €1,554 million with its weapon systems and ammunition activities in the first nine months of 2024 exceeding the previous year’s sales by €608 million or 64%. The increase compared to the same period of the previous year is attributable in particular to higher ammunition deliveries. Key projects included artillery orders for Germany and Ukraine. With sales of €352 million, Rheinmetall Expal Munitions, acquired on July 31, 2023, contributed significantly to this growth.

At €10.2 billion, the Rheinmetall Nomination is significantly higher than the previous year’s figure after nine months of the 2024 fiscal year (previous year: €7 billion). An essential driver is a framework agreement in the gross amount of €8.5 billion for artillery ammunition by the German customer. Further growth was generated in Germany and the countries in West Asia for indirect fire and medium calibre products.

As of September 30, 2024, the Rheinmetall Backlog reached around €20 billion. Compared to the previous year’s figure (September 30, 2023: €11.3 billion), the increase was more than €8 billion or 73%. The drivers for this were the conclusion of two multi-year ammunition framework agreements in the second half of 2023 and the subsequent increase in the artillery framework agreement by the German customer in June 2024.

The operating result almost doubled by the end of the third quarter of 2024 with an increase of €163 million or 93% to €339 million (previous year: €175 million). This includes an earnings contribution of €117 million from Rheinmetall Expal Munitions. Despite higher staff and material, the operating result margin improved significantly from 18.5% to 21.8%.

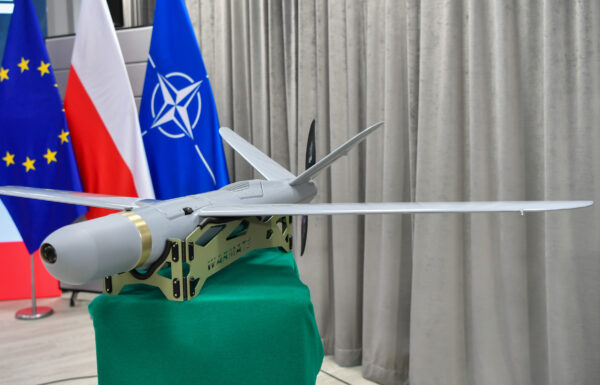

Electronic Solutions: Rheinmetall Nomination tripled – Air defence as a driving force

Electronic Solutions, with products in the field of armed forces digitalization, infantry equipment, air defence and simulation, increased its sales after nine months of the 2024 fiscal year by €218 million to €1,038 million (previous year: €820 million); this corresponds to an increase of 27%. The sales upswing is essentially the result of an order by the German Bundeswehr for the Skyranger 30 mobile air defence system and the NNBS short range air defence system, additional deliveries for the Puma infantry fighting vehicle and the modernization of an existing air defence system for a European customer.

Compared to the same period of the previous year, Rheinmetall Nomination more than tripled from €1 billion to €3.5 billion. A development contract for the short- and very short-range air defence system and a supply contract for the mobile Skyranger 30 air defence system were the key order intakes received by the German customer. Furthermore, the conclusion of a framework agreement for the delivery of communication and hearing protection headsets as well as a portion in the commissioning for the manufacture and supply of the Boxer armoured vehicle as infantry heavy weapons carrier for the German armed forces should be named. The Rheinmetall Backlog was at €6.7 billion on September 30, 2024. Therefore, it is significantly higher than the previous year’s figure by almost €3 billion (previous year: €3.7 billion).

The operating result strengthened by the end of the third quarter of 2024 to €96 million, after €56 million in the previous year. Due to a favourable product mix, the operating margin increased to 9.2% (previous year: 6.9%).

Power Systems: Sales slightly below the previous year, backlog still at a high level

At €1,543 million, sales at Power Systems, which bundles technological expertise in civilian markets, are slightly below the previous year’s figure in the period under review (previous year: €1,551 million). After the past nine months of the 2024 fiscal year, the booked business was slightly below the previous year at €2.1 billion (previous year: €2.4 billion). The nominated backlog as of September 30, 2024 fell by 9.2% to €8.1 billion (previous year: EUR 8.9 billion).

The operating result fell by 4% to €74 million compared to the previous year (previous year: €77 million). The operating margin dropped slightly to 4.8% (previous year: 5%).

Outlook: Current guidance for 2024 confirmed

Rheinmetall confirms its sales and earnings guidance for full year 2024 after the first nine months of fiscal year 2024 based on the expected business performance in the fourth quarter. Including acquisitions in the current fiscal year 2024 – including holding costs – the Group expects to achieve group revenue of around €10 billion. The Group now expects the operating margin to be around 15%, at the upper end of the guidance (2023: 12.8%).

#FinancialReport for the third quarter of 2024 – #Rheinmetall presents record #figures: #Sales are rising by more than a third, #earnings increase by more than 70% https://t.co/fne5AcqN7X #finance #q3 #quartelyreport pic.twitter.com/mNTnmut89V

— Rheinmetall (@RheinmetallAG) November 7, 2024

Press release